Tom Hartmann, 2022

Do you know much about the cause of the recent spike in the cost of living in New Zealand?

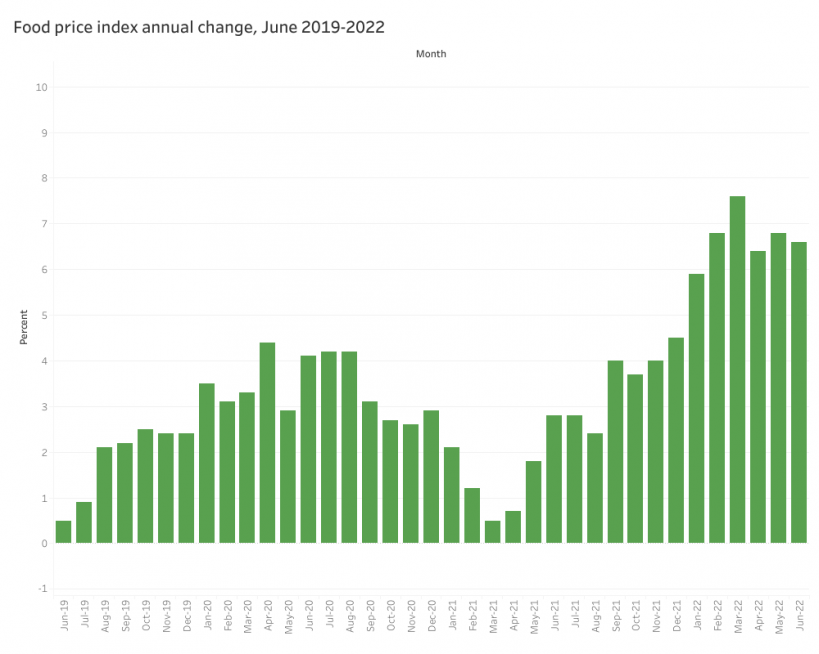

When there is more money chasing less goods (demand), or when those goods become more costly to produce (supply), you get inflation. In these times of Covid, we’ve had both happen! Much of it is happening in housing, which affects students less, but it has found its way into transport and of course the everyday products and food we buy.

Would you say the current cost of living is especially tough on students?

The rising cost of living is especially hard on anyone living on a fixed income these days, but even more so when incomes are lower towards the beginning of your working life. So yes, it’s especially tough on students, definitely.

Two-thirds of students regularly do not have enough money to buy food, clothing, pay bills, get health care or other basics. How can students better-navigate the cost of living crisis?

There are really only two ways: either increase income or cut expenses. On the income side, finding a side hustle or some gig work can help fill the gaps. On the expenses side, having a laser-focused plan for your spending (a.k.a. a budget) is a good way to start. Sorted’s budgeting tool is made for this.

But before just cutting things out randomly, it’s important to keep your spending as happy as possible. Meaning: you can rank your expenses by their emotional return: anything that leaves you feeling ‘meh’ you can cut, but you want to keep those things that keep you elated, that delight you. (There’s more on Sorted on how to do this.)

A 2022 study on student expenditure showed that on average 56% of a student's income is spent on rent alone. Do you have any budgeting advice for students whose sole income is through Studylink and/or low income part-time employment?

First off, let’s acknowledge that anything above 30% on housing is a stressful situation. Ideally, you’d want it even lower than that.

If you’re planning on studying, you want to avoid this situation any way you can. If this is already your situation, you may have to find ways to make it work, but we can all agree that it’s tough.

Anything you can do to come down from 56% will help, but otherwise it will take walking a financial tightrope to make that work.

How would you recommend students learn financial literacy? What resources are available to us?

At Sorted we’d recommend going beyond financial literacy actually, which is mainly about what you know. There’s a huge leap between knowing the right thing and doing the right thing.

What we need is financial capability, which includes the skills needed to handle money well… and actually doing it. It means we can meet our needs now, and be on track to meet them in the future.

Intriguingly, the experience of managing limited income as a student is a hands-on experience that can significantly lift your financial capability. If you can thrive on a shoestring, you will be better placed to handle a larger income down the line.

What advice would you give for students anxious about the cost of their student loans? Some are concerned it may impact their ability to save for a house, retirement etc. How would you recommend students approach saving for these while making loan repayments?

As a rule of thumb, you only want to be borrowing what you really need. But having said that, it’s important not to stress out too much about student loans, which are interest-free as long as you are here in New Zealand. There’s really no need to pay them off any faster than required.

Because of that, you can actually prioritise saving for your future goals while you pay off your loan in the background. Especially with any extra work you find, you can funnel money towards your future. And that student loan will get paid off in the end, too.

Disposable income is a necessity for maintaining mental health and enjoyment of life. How would you recommend students manage their money to ensure they have disposable income for hobbies, socializing etc?

Definitely! You want to budget for the things you can enjoy too – call it a ‘splurge’ fund, for example. Again, you can make a plan for your spending and make sure it includes those things that make you most happy. You’ll find there’s lots you can do – you just can’t do everything at once! You also may find many things that improve your wellbeing that don’t cost much at all.